9,000+

40,000,000+ Euro

40+ Years

40+

The FINEXITY multi-asset asset classes and why we have selected them for you

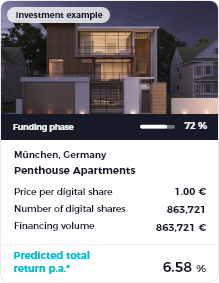

Real estate as the foundation for your portfolio

With real estate as an asset class, you benefit from both potential performance and ongoing rental income. Our investment focus is on new construction projects in Germany's A cities

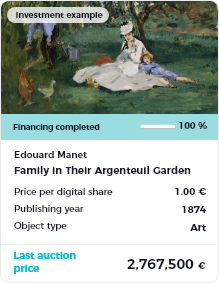

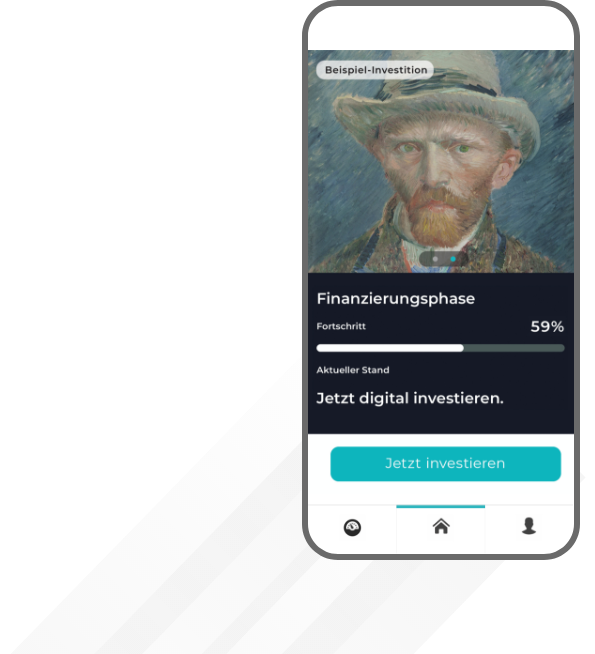

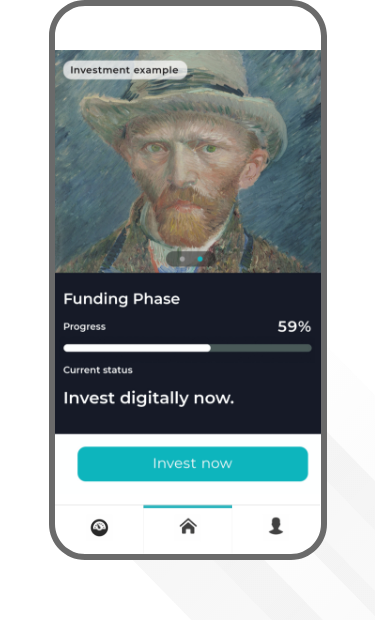

Art as inspiration for your portfolio

In addition to the emotional value and personality cult around individual artists, hard performance indices also speak in favor of art as an investment form. Even during the selection process, we attach great importance to the highest possible profitability of works of art.

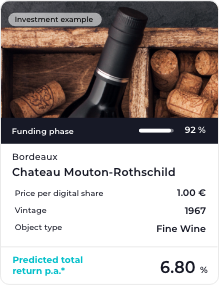

Fine Wine as a tasteful addition to your portfolio

With Fine Wine you secure a maturing return on your portfolio: The quality and value of the wines increases when they approach their best drinking window. The constantly growing demand contrasts with limited production capacities in the sought-after wine-growing regions.

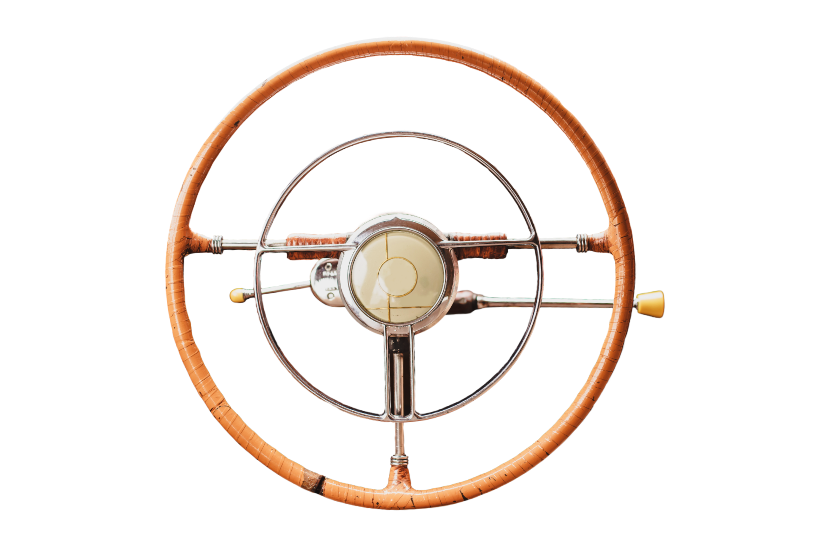

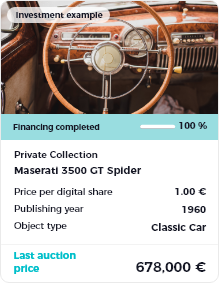

Classic cars as the engine for your portfolio

For the evaluation and selection of classic cars, the current and past market price, the substance and a complete vehicle history are decisive. Our global partner network ensures optimal selection, safekeeping and maintenance.

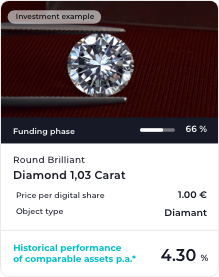

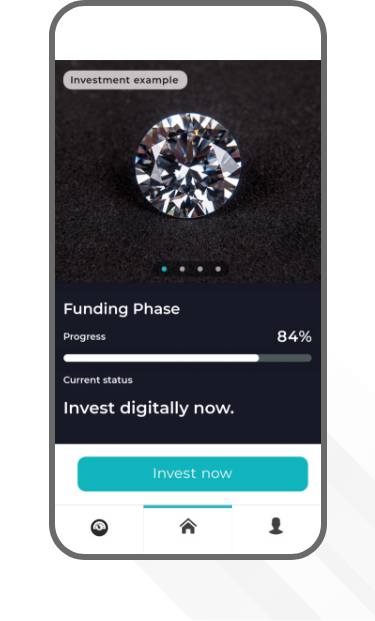

Diamonds as a classic beauty for your portfolio

Diamonds are the most concentrated form of all physical assets. They combine high assets in the smallest of spaces and are characterized by low volatility and low correlation to other asset classes.

The 3 Most Important Reasons for Real Estate as an Attractive Asset Class

Risk optimization and expertise

Established networks provide access to first-class investment opportunities. Together with independent appraisers, our experts examine every investment opportunity. The focus here is not on the maximum return, but on risk optimization.

Partnership with banks

As a rule, the properties are partially financed by partner banks on optimized terms. Investors benefit from the leverage effect and repayment gain without taking out a loan themselves.

High quality management

Our investment focus is on new residential properties in Germany's A cities as well as holiday apartments in the most attractive locations in Europe. We think long-term and always manage at an above-average level.

The 3 Most Important Reasons for Art as an Attractive Asset Class

Market stability & value enhancement

Due to its illiquidity, a long-term investment horizon and a constant to increasing demand, the art market can be characterized as stable in value.

Learn moreDiversification & Security

Due to a low correlation to liquid asset classes and the separate hedging and insurance measures, art is a robust component in the portfolio.

Learn moreExclusivity & Prestige

The art market enjoys a high degree of exclusivity and prestige due to its very wealthy buyers and the emotional character of its objects.

Learn more

The 3 most important reasons for Fine Wine as an attractive asset class

Market stability

Due to the illiquidity and the material value of the wines, as well as a typically long-term investment horizon, the Fine Wine market can be characterized as stable in value.

Learn moreValue enhancement

Since demand rises constantly, wines gain quality over time and the already rare offers decrease due to consumption, prices rise.

Learn moreDiversification & security

Due to a low correlation to other asset classes, as well as the separate security and insurance measures, Fine Wine is a robust component in the portfolio.

Learn more

The 3 Most Important Reasons for Classic Cars as an Attractive Asset Class

Value maintenance & performance

Due to its natural scarcity and high demand, the classic car market has stable value and the opportunity for above-average returns.

Learn moreDiversification & Security

As capital goods, classic cars are particularly interesting because of their relatively low dependence on the capital market.

Learn moreEmotionality & Status

Due to the representative and emotional power of his vehicles and the prosperous group of buyers, the price premiums are higher than for traditional asset classes.

Learn more

The 3 Most Important Reasons for Diamonds as an Attractive Asset Class

Market stability

Due to the illiquidity and real value of diamonds, as well as a typically long-term investment horizon, the diamond market can be characterized as stable in value.

Learn moreIncrease in value

Since the demand for diamonds, especially in Asia, is constantly increasing and this demand is offset by a stagnating supply of diamonds, their prices are rising.

Learn moreDiversification & Security

Due to a low correlation to other asset classes and the separate security and insurance measures, diamonds are a robust component in the portfolio.

Learn more

Become part of the FINEXITY community now and receive exclusive information on new projects

Already registered? Log in here.

E-Mail Address / Mobile Number

or