Frequently asked questions

Ich habe mein Passwort vergessen, was nun?

Sollten Sie Ihr Passwort vergessen, können Sie es über die Passwort vergessen-Funktion ganz einfach zurücksetzen und sich ein neues Passwort vergeben.

Is there an app?

Yes, there is a FINEXITY app that can be used both in iOS App Store from Apple and for Android users in Google Play Store is available.

With the app, you have an even more convenient overview of your portfolio, can trade digital shares at any time and are always up to date on all performance developments. The app is protected by an additional security PIN.

How do I contact FINEXITY?

You can reach us via our contact form or telephonic Monday to Thursday from 10:00 a.m. to 7:00 p.m., Friday from 10:00 a.m. to 6:00 p.m. at +49 40 822 177 20. We look forward to hearing from you!

Alternatively, you can reach us anytime via email under support@finexity.com. There, we will take care of your request within a very short time.

How can I delete my account?

If you have decided that you do not want to take advantage of the FINEXITY platform and want to permanently delete your account, you can simply do this yourself in your dashboard.

To do this, click on “Settings” in the top right corner of the account area and then on the “Delete account” sub-area.

Attention! If you carry out the deletion process, we will irretrievably delete your account data.

How can I identify myself?

When opening an account, we are required to carry out an identification that complies with the principles of the Money Laundering Act (GwG). You can do this in two ways: digitally or at the post office. Both procedures are legally compliant, sure and gratuitous for you.

If you would prefer to provide proof of identity yourself, you can contact POSTIDENT Proceedings of Deutsche Post ID at the branch. Simply download the necessary PDF file on the FINEXITY platform during the identification process and print it out. With the printed PDF document and your identity card, visit a post office of your choice and identify yourself locally.

If you prefer digital authentication, use the online service IDnow and identify yourself online via the web or via the IDnow app, all you need is a computer, a tablet or a smartphone. On IDnow's partner site, you can identify yourself within a few minutes using an expert video chat with your identity card.

How can I subscribe to, manage and unsubscribe from the newsletter?

As soon as you have registered for free on Finexity.com, you are an active part of our weekly main newsletter.

You can easily subscribe to and manage all newsletters in your account (top right corner) on the dashboard. Click on the section “Email subscription.” There, you can subscribe to other selected newsletters and manage your settings by clicking on them.

You can also manage or unsubscribe to subscribed newsletters by scrolling all the way down in the newsletter email. There you will find a link in the footer “Manage or unsubscribe from newsletters”. Clicking on this will take you to the administration area of your newsletter subscriptions. There, you can manage or unsubscribe from selected newsletters by clicking on them.

How do I create a password?

You will be asked to enter a password of your choice immediately upon registration. Choose a hard-to-guess password of at least six characters, preferably with a combination of uppercase and lowercase letters, numbers, and special characters.

If you forget your password, you can do it via Forgotten password function Simply reset and set yourself a new password.

How do I register?

You can register via the website https://finexity.com/register. To create your account, enter your email address and phone number One and give a safe password. Now all you have to do is confirm your email address — we'll send you a confirmation email. You can then log in, complete your personal details and go to the marketplace Invest from 500 euros.

Registration with FINEXITY is complete free of charge. After just a few clicks, you have full access to your personal dashboard in no time.

Was passiert, wenn eine Finanzierung nicht zustande kommt?

In seltenen Fällen kommt es vor, dass eine Finanzierung nicht zustande kommt. In einem solchen Fall wird das entsprechende Projekt rückabgewickelt und die Anleger bekommen Ihre Investitionssumme zurück.

Muss ich Geld in das Wallet einzahlen, um zu investieren?

Für Käufe und Verkäufe von Anteilen über den Sekundärmarkt ist die Wallet erforderlich. Um Käufe zu tätigen, muss Guthaben in entsprechender Höhe auf der Wallet vorhanden sein. Ebenso werden Erlöse aus Verkäufen auf der Wallet gutgeschrieben. Diese Erlöse können Sie am Ende kostenfrei auf Ihr Bankkonto auszahlen lassen.

Kann ich meine Investition frühzeitig und selbstständig veräußern?

Sobald Projekte vollständig finanziert und tokenisiert sind, können Sie jederzeit ihre persönlichen Anteile auf dem Sekundärmarkt handeln. Dabei fallen keine weiteren Kosten an.

Welche Zahlungsarten bietet FINEXITY an?

Neben der Zahlung per Überweisung bietet FINEXITY zur schnellen Abwicklung auch ein sogenanntes Wallet an. Dieses digitale Guthabenkonto übernimmt die Funktion einer virtuellen Geldbörse und kann ich beliebiger Höhe aufgeladen werden.

Was ist der Unterschied zwischen Retail und Club Deal Tranche?

Retail-Investments sind ab 500 EUR möglich. Club Deals beginnen in der Regel bei 5.000 EUR, bieten aber auch verbesserte Konditionen.

Um Clubs Deals zu zeichnen ist eine vorherige Aufnahme in unser Clubs Deal Programm notwendig. Dies können Sie über die Account Einstellungen oder diesen Link beantragen.

Werden bei den möglichen Renditen noch Kosten abgezogen?

Nein, es fallen für Investoren keine Kosten an.

How do I invest in my dream property?

First of all, you must register for free on Finexity.com.

The next step is to choose your dream property — feel free to use all the documents and data we have provided to make the best investment decision for you.

Then complete your profile and verify yourself via one of our providers (IDnow, POSTIDENT). As soon as this is successfully completed, you are ready to go.

Select a property, determine the investment amount and be involved for as little as 500 euros — you can pay securely via bank transfer.

Do TOKENIZED FINEXITY bonds require a prospectus?

No The Finexity tokens are — due to transferability and (potential) tradability on a secondary market — to be qualified as securities within the meaning of Article 4 (1) No. 44 of Directive (EU) 2014/65 (MiFID II) and Section 2 No. 1 WpPG in conjunction with Art. 2a Regulation (EU) 2017/1129, meaning that they are not subject to the provisions of the Asset Investment Act.

The school securities are issued by the respective property companies, which act as issuers of the corresponding bond. Property companies are not subject to a prospectus requirement, but comply with the relevant prospectus exemption regulations. These exemptions result from the directly applicable ProspectVO in conjunction with the WpPG.

As an investor at FINEXITY, do you have a direct interest in tangible assets?

We have worked with our lawyers for a long time on a solution that enables us to directly on a tangible asset How to a property participate. The issue, however, is that we cannot register 1000 investors in the land register. In addition, this would extremely restrict potential trading of shares and would therefore make the fungibility of a Investment token (security in accordance with §2 WpPG). Direct participation would also result in problems, such as real estate transfer tax.

With our construct, investors benefit from a flexible asset, which is not yet available on the market.

What does my investment cost?

Your investment via the FINEXITY platform does not cost you any fees. You can invest in any of the tangible assets and investments at no additional cost. Buying and selling digital shares on the FINEXITY secondary market is also free of charge.

In principle, there are costs when buying a tangible asset, whether the purchase is made privately or by a company. The costs incurred, such as the acquisition and management of the tangible asset, are not offset as a fee against your investment amount, but are borne by a special purpose vehicle that holds the tangible asset. FINEXITY AG is connected to a liability umbrella to provide investment brokerage for the financial instrument. The investment brokerage also results in costs on the part of the special purpose company.

These costs are not directly incurred by investors, but have a diminishing effect on the forecast return. If you invest an amount of 500 euros, 100% of this 500 euros goes to the special purpose vehicle. The exact costs are listed in the financial calculation of the investment and are available on the product detail page and in the documents.

What are the benefits of private market investments?

In recent years, investments in private markets have proven to be extremely successful. For example, private equity investments have regularly exceeded public market returns, which has significantly increased interest and access to these investment opportunities. The traditional 60/40 division between stocks and bonds is no longer sufficient to meet today's financial requirements. A balanced mix of public and private market investments is essential. A strategic allocation to private markets can diversify and optimize the portfolio regardless of the investment horizon. With the help of a trading venue, FINEXITY brings issuers and trading partners together, giving investors access to high-yield and tradable tokenized private market investments.

How do investments via FINEXITY work?

A digital security is structured via an issuer. This is offered to investors as an investment via a trading partner (e.g. Finexity Invest GmbH). To do so, investors must register on the trading partner's marketplace. Here they can find out more about the investment and view and download the documents provided by the issuer. After successful online authentication via the provider IDnow, they can make the investment. Payment can be made via bank transfer or via the integrated e-wallet solution. As soon as the financing volume of an investment has been reached, the tokens are issued into users' wallets. The investment now appears as an asset on each user's dashboard.

Who is the owner of the investment property?

The owner of the investment property is an object company provided by an issuer. This property company acquires the corresponding property with the capital provided by the investors' tokenized bonds and possibly bank financing. A trading partner (e.g. Finexity Invest GmbH, under the liability umbrella of Effecta GmbH) acts as a (bound) intermediary between the issuer and the investors. This enables investors to subscribe to tokenized bonds that are structured as economic as (pro rata) direct investments. Investors therefore participate in selected investment properties just like owners, but also bear certain risks, which are described in detail in the respective bond conditions and subscription documents.

In welchen Assetklassen kann ich Produkte emittieren?

Aktuell werden über FINEXITY Produkte aus den Assetklassen Corporate, Real Estate, Infrastructure und Collectibles angeboten.

Grundsätzlich lassen sich aber nahezu alle Assetklassen tokenisieren. Sprechen Sie uns dazu gerne an

Über wen wir mein Finanzprodukt vertrieben?

Ihr Produkt wird über den Handelsplatz der FINEXITY vertrieben.

Welche Finanzprodukte können emittiert werden?

Aktuell können sowohl Wertpapiere sui generis (Security Token) als auch Kryptowertpapiere nach eWpG emittiert werden.

What does tokenization mean?

FINEXITY offers investors the opportunity to invest in various tokenized tangible assets such as real estate investments. Through blockchain-based tokenization, FINEXITY has the ability to create legitimate Possession claims log and at the same time the trafficking to be able to represent these ownership claims.

The tangible asset is purchased through the money collected and through 65 percent financing with a bank. A digital share of one euro each is shown on the blockchain. The successful financing results in tokens equivalent to the financing volume. Every investor receives tokens in the amount of their investment. The tangible asset is thus tokenized (asset-backed tokens).

We set the construct with its various parameters with Smart Contracts um. The terms of the investment are laid down in this digital contract. After the tokens have been issued to investors, we receive a logged order book with which we are able to legally identify who is currently invested. Through our marketplace, investors can offer their shares for sale directly to other investors.

Weitere Fragen zum White-Label-Marktplatz Angebot für Handelspartner?

Unser Team hilft Ihnen gerne weiter!

Buchen Sie sich gerne einen Termin oder kontaktieren Sie unseren Ansprechpartner:

Oliver Becker

Head of Banking

E-Mail: oliver.becker@finexity.com

What does tokenization mean?

FINEXITY offers investors the opportunity to invest in various tokenized tangible assets such as real estate investments. Through blockchain-based tokenization, FINEXITY has the ability to create legitimate Possession claims log and at the same time the trafficking to be able to represent these ownership claims.

The tangible asset is purchased through the money collected and through 65 percent financing with a bank. A digital share of one euro each is shown on the blockchain. The successful financing results in tokens equivalent to the financing volume. Every investor receives tokens in the amount of their investment. The tangible asset is thus tokenized (asset-backed tokens).

We set the construct with its various parameters with Smart Contracts um. The terms of the investment are laid down in this digital contract. After the tokens have been issued to investors, we receive a logged order book with which we are able to legally identify who is currently invested. Through our marketplace, investors can offer their shares for sale directly to other investors.

Können alle Projekte auf dem Sekundärmarkt gehandelt werden?

Der Großteil aller auf verfügbaren Projekte kann über den Sekundärmarkt gehandelt werden. Ausnahmen sind einzelne Club-Deals sowie Kryptowertpapiere nach eWpG. Diese sind zur Zeit leider noch nicht handelbar, allerdings arbeiten wir daran, dies zukünftig zu ändern.

Wer kann den Sekundärmarkt nutzen?

Jeder registrierte und verifizierte Nutzer der Plattform über den Sekundärmarkt kaufen und verkaufen.

Welche Vorteile bietet der Sekundärmarkt?

Über den Sekundärmarkt haben Sie jederzeit die Möglichkeit, Ihre Anteile zum Verkauf anzubieten oder angebotene Anteile zu erwerben. So profitieren Sie von zusätzlicher Liquidität und haben zusätzlich die Möglichkeit, Anteile von vollständig gezeichneten Projekten zu erwerben.

Ist der Sekundärmarkthandel kostenpflichtig?

Nein, der Handel auf dem Sekundärmarkt ist sowohl für Käufer als auch Verköufer kostenfrei.

How can I buy digital shares via the FINEXITY secondary market?

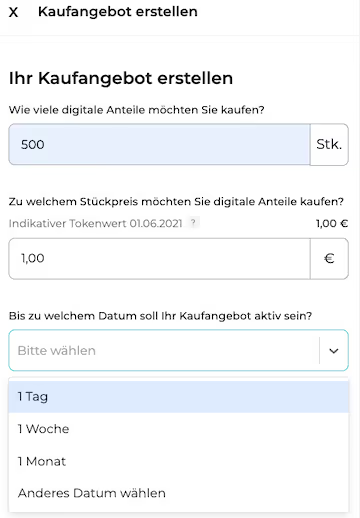

If you are interested in buying digital shares of tokenized securities, you can use the detail page of each project approved for the secondary market to create a Set a purchase offer.

If you already find a sales offer there whose terms meet your expectations, you can accept it directly and purchase digital shares. In order to be able to post your own purchase offer, you must first Credit on your e-wallet deposit.

If a seller accepts your purchase offer, the total purchase price is deducted from your FINEXITY e-wallet and the digital shares are sent to you.

Is there a minimum holding period for my investment?

No, you can offer your digital shares for sale on our FINEXITY marketplace at any time.

How is the indicative token value (ITV) calculated?

The indicative token value (ITV) reflects the Current indicative asset per token Against. This includes the current profit sharing based on the current market value of the reference value (tangible asset), the relevant bank balances on the reporting date, the unamortized acquisition and exit costs, any outstanding management fees and all other liabilities.

The information was calculated by the issuer to the best of her knowledge and belief. FINEXITY has no influence on the values. All information is without guarantee.

Are there limits and limits on the FINEXITY secondary market?

On the FINEXITY secondary market, the minimum purchase quantity of 500 digital shares.

A buy or sell offer must include at least 500 digital shares — this limit applies analogously to the acceptance of an existing offer to buy or sell.

How can I sell my digital shares via the FINEXITY secondary market?

If you own digital shares of tokenized securities and decide to sell your investment tokens, you can use the detail page of each project approved for the secondary market to Post a sales offer.

If you already find a purchase offer there whose conditions meet your expectations, you can accept it and sell your digital shares. Alternatively, you can set up your own sales offer.

If a buyer accepts the offer, the sale is initiated: Your digital shares are transmitted to the buyer and the Sales revenue credited to your e-wallet.

How is the Token Market Price (TMP) calculated?

The token market price (TMP) represents the Current daily token price Dar.

This is the weighted average all tokens traded the previous day (00:00 - 23:59) of the respective project.

Weitere Fragen zum Partnerprogramm?

Unser Team hilft Ihnen gerne weiter!

Buchen Sie sich gerne einen Termin oder kontaktieren Sie unseren Ansprechpartner:

Kevin R. Borowski

Manager Digital Family Office

Tel.: +49 40 299 960 175

E-Mail: kevin.borowski@finexity.com

Was ist als Teilnehmer des Partnerprogramms zu beachten?

Teilnehmer des Partnerprogramms dürfen nicht beratend tätig werden. Es darf lediglich ein Hinweis auf das Unternehmen FINEXITY sowie das vielfältige Angebot gegeben werden.

Wie kann ich am FINEXITY Partnerprogramm teilnehmen?

Um am FINEXITY Partnerprogramm teilzunehmen, wenden Sie sich bitte direkt an unseren Partner Manager Kevin Borowski.

Kevin R. Borowski

Manager Digital Family Office

Tel.:+49 40 299 960 175

E-Mail: kevin.borowski@finexity.com

An wen richtet sich das FINEXITY Partnerprogramm?

Das Partnerprogramm richtet sich in erster Linie an Finanzvermittler oder Personen bzw. Unternehmen mit ähnlicher Ausrichtung.

Was ist das FINEXITY Partnerprogramm?

Über das FINEXITY Partnerprogramm können Sie Ihren Kunden renditestarke und handelbare Investitionen in Private Markets anbieten, die normalerweise nur professionellen Anlegern vorbehalten sind.

Als Partner erhalten Sie attraktive Provisionen - und verdienen so automatisch bei jeder Investition Ihres Kunden mit.

Is the FINEXITY blockchain decentralized?

The FINEXITY blockchain is a private permissioned blockchain on Ethereum. In doing so, we comply with the strict financial regulatory requirements in Germany. This guarantees legal security for our investors.

There is therefore no decentralization at this stage, but we have taken a first step towards decentralization within the scope of current legislative and market conditions. As soon as social requirements and circumstances permit, we will further expand the opportunities offered by blockchain and work with other digital token providers, for example.

Is my investment safe with FINEXITY?

Investment security of the investment property

Everyone Tangible value goes through our own Evaluation process process and is then presented in a multi-member council and, if necessary, rejected or added to our portfolio.

In general, we are not yield-driven, but rely on long-term investments and don't take unnecessarily high risks. However, the purchase of our securities involves significant risks and may result in the complete loss of invested assets.

Technological security of digital shares

The use of blockchain technology (Permissioned blockchain) to implement the Tokenization is coordinated with the supervisory authorities and is therefore subject to legal regulations.

The digital shares are self-held in the FINEXITY wallet, which is digital locker serves. FINEXITY provides every user with a wallet free of charge. You don't need an additional deposit.

Is FINEXITY the owner of the investment?

No For each specific investment project, a property company is set up, which acts as the issuer of the corresponding bond. The property company acquires the project in question with the capital made available through the bonds.

The FINEXITY platform acts as an intermediary that allows you as an investor to subscribe to tokenized bonds that are structured economically as (pro rata) direct investments.

Like an owner, you participate in selected tangible assets, because as an investor, you rank directly after the bank (subordinated bond). Each bond for a specific property is issued by a 100% subsidiary of FINEXITY in the legal form of a GmbH & Co. KG.

In order to ensure the security of your digital assets in the best possible way, we thoroughly check the objects beforehand and focus our management on maintaining value and minimizing risks. The blockchain enables us to issue investment tokens in a legally compliant manner.

Do TOKENIZED FINEXITY bonds require a prospectus?

No The Finexity tokens are — due to transferability and (potential) tradability on a secondary market — to be qualified as securities within the meaning of Article 4 (1) No. 44 of Directive (EU) 2014/65 (MiFID II) and Section 2 No. 1 WpPG in conjunction with Art. 2a Regulation (EU) 2017/1129, meaning that they are not subject to the provisions of the Asset Investment Act.

The school securities are issued by the respective property companies, which act as issuers of the corresponding bond. Property companies are not subject to a prospectus requirement, but comply with the relevant prospectus exemption regulations. These exemptions result from the directly applicable ProspectVO in conjunction with the WpPG.

As an investor at FINEXITY, do you have a direct interest in tangible assets?

We have worked with our lawyers for a long time on a solution that enables us to directly on a tangible asset How to a property participate. The issue, however, is that we cannot register 1000 investors in the land register. In addition, this would extremely restrict potential trading of shares and would therefore make the fungibility of a Investment token (security in accordance with §2 WpPG). Direct participation would also result in problems, such as real estate transfer tax.

With our construct, investors benefit from a flexible asset, which is not yet available on the market.

What makes FINEXITY different from a subordinated loan?

Our product is not an investment in accordance with Section 1 Paragraph 2 No. 3 VermanLG (Partiarial Loan), Section 1 Paragraph 2 No. 4 VermanLG (Subordinated Loan) and other investments within the meaning of Section 1 Paragraph 2 No. 7 VermanLG. In fact, our investment product is classified as a security token (security token/investment token (BaFin classification)).

By structuring our investment options, investors are always right after the bank in the rank of creditors — just like any owner of a property.

How are my profits taxed?

Taxation is based on the contract on which the smart contract is based. It takes place regardless of how the investment token is designed on the technical side.

In the case of the products on our platform, these are bonds owed to the respective special purpose vehicle that issues the corresponding product. Profits from this are subject to capital gains tax of 25% in Germany.

In principle, winnings can be triggered in three different ways:

- Distributions (e.g. in the case of real estate through rental income) — Here, the tax is not paid out to investors in the first place, but withheld directly by the issuer and paid to the tax office.

- Profitable sales on the secondary market — Here, every investor receives a list of all their transactions and the associated tax burden for the respective calendar year. This list is relevant for the tax return, in which these tax-effective profits must be stated.

- Involvement in the sale of tangible asset — When an asset is sold for profit, tax is withheld and investors receive their net profits directly.