OUR MISSION

Driving opportunities in Private Markets.

Creating the leading exchange for Digital Assets.

NEWS & INSIGHTS

FINEXITY FOR EVERYONE

One Platform for all Audiences

Investors - invest in Private Markets with ease

FINEXITY gives investors access to high-yield and tradable Private Market-Investments.

Invest now

Issuers - tap into tomorrow’s Capital Market

FINEXITY offers issuers an efficient and cost-effective way to raise capital for their projects.

More information

Trading Partners - instant access to the Digital Trading Venue

FINEXITY enables trading partners and their clients to access a broad universe of Private Market-Investments.

More informationFACTS

FINEXITY — the Trading Venue for Private Market-Investments

250+

Listings

84.000+¹

registered Investors

6

active

trading partners

27M EUR

Growth Capital

¹FINEXITY Group: 14,000 + Effecta GmbH: 70,000. The figures shown are pro forma, unaudited, and for illustrative purposes only. The acquisition of 90.10% of Effecta GmbH remains subject to the successful completion of the ownership control procedure (Inhaberkontrollverfahren).

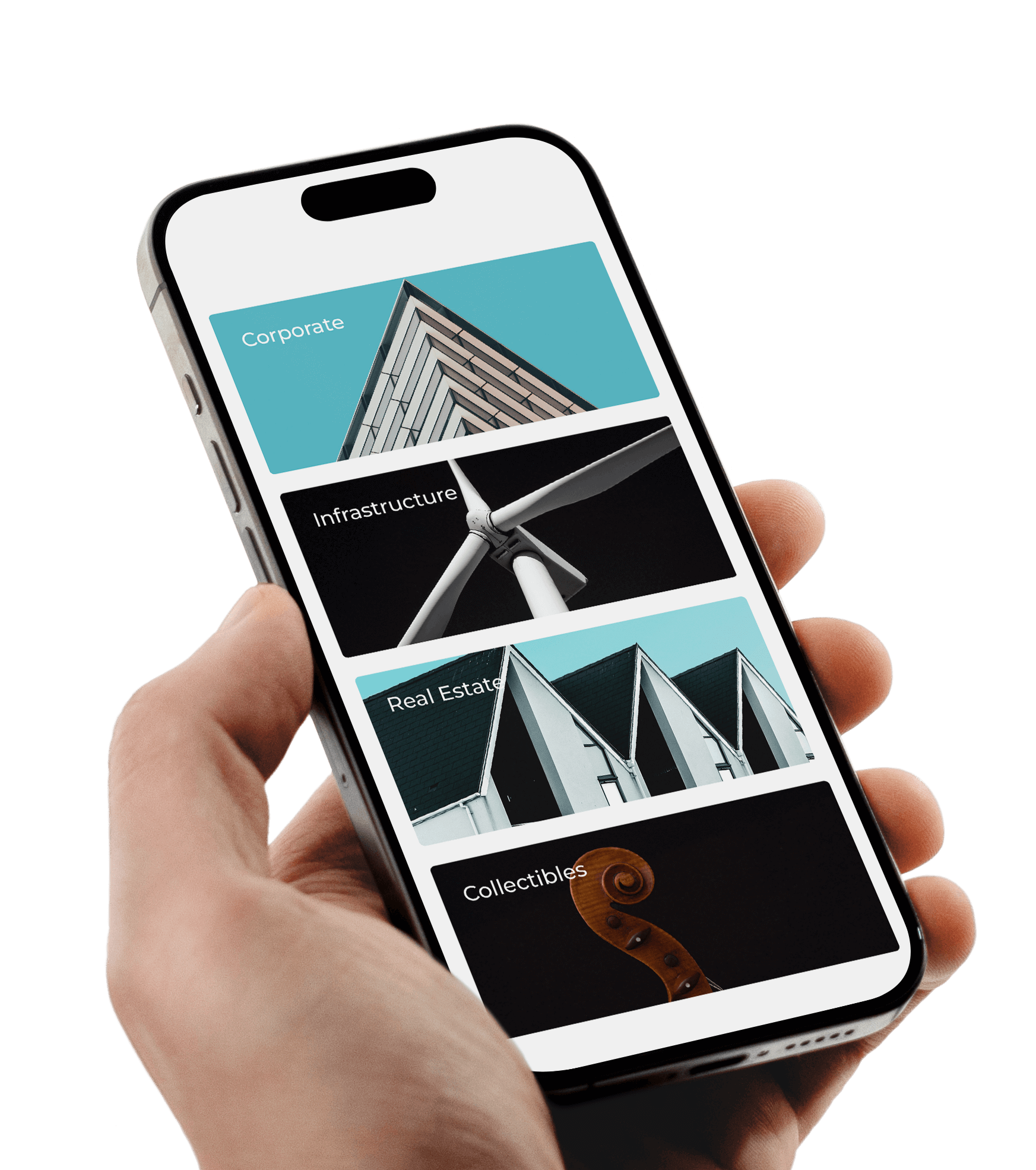

ASSET CLASSES

A Broad Range of Investment Opportunities

Corporate

By investing in corporate equity, our investors participate in the potential of entrepreneurial initiatives and innovation. Through investments in, for example, private equity, investors directly benefit from the economic success and value appreciation that can result from IPOs or market expansions.

Real Estate

Real estate in the residential, commercial, hospitality, or healthcare sectors offers protection against inflation and enables regular income through rental and lease payments in addition to potential value appreciation.

Infrastructure

Infrastructure investments, such as solar parks, provide a robust foundation for portfolios. They generate stable, inflation-protected cash flows and are characterized by low correlation with traditional asset classes.

Collectibles

Collectibles such as fine art, fine wine, or classic cars add a touch of individuality and emotion to a portfolio. Often driven by passion, these investments combine aesthetic and artisanal value with attractive appreciation potential due to their rarity or historical significance.

-p-1080.jpg)

Citizen participation

Citizen participation as an investment opportunity can take many forms – such as wind and solar parks, daycare centers, or the local public pool. This type of involvement not only ensures the realization of local projects but also enables citizens to actively participate in these initiatives.

.jpg)

FINEXITY in the Media

The most important things at a glance

What are the benefits of private market investments?

In recent years, investments in private markets have proven to be extremely successful. For example, private equity investments have regularly exceeded public market returns, which has significantly increased interest and access to these investment opportunities. The traditional 60/40 division between stocks and bonds is no longer sufficient to meet today's financial requirements. A balanced mix of public and private market investments is essential. A strategic allocation to private markets can diversify and optimize the portfolio regardless of the investment horizon. With the help of a trading venue, FINEXITY brings issuers and trading partners together, giving investors access to high-yield and tradable tokenized private market investments.

What does FINEXITY's range of services look like?

With the help of a trading venue, FINEXITY brings issuers and trading partners together, giving investors access to high-yield and tradable tokenized private market investments. Issuers of digital securities (security tokens and, in future, crypto securities) thus benefit from access to trading partners and investors, which leads to faster fundraising with lower asset management fees. FINEXITY offers trading partners, such as banks and asset managers, access to pre-qualified private market investments via a white label solution. This enables them to attract new investors, retain existing customers, and at the same time build up more crisis-resilient portfolios. Investors benefit from high-yield private market investments with lower capital requirements, improved liquidity, lower costs and greater transparency.

How do investments via FINEXITY work?

A digital security is structured via an issuer. This is offered to investors as an investment via a trading partner (e.g. Finexity Invest GmbH). To do so, investors must register on the trading partner's marketplace. Here they can find out more about the investment and view and download the documents provided by the issuer. After successful online authentication via the provider IDnow, they can make the investment. Payment can be made via bank transfer or via the integrated e-wallet solution. As soon as the financing volume of an investment has been reached, the tokens are issued into users' wallets. The investment now appears as an asset on each user's dashboard.

Who is the owner of the investment property?

The owner of the investment property is an object company provided by an issuer. This property company acquires the corresponding property with the capital provided by the investors' tokenized bonds and possibly bank financing. A trading partner (e.g. Finexity Invest GmbH, under the liability umbrella of Effecta GmbH) acts as a (bound) intermediary between the issuer and the investors. This enables investors to subscribe to tokenized bonds that are structured as economic as (pro rata) direct investments. Investors therefore participate in selected investment properties just like owners, but also bear certain risks, which are described in detail in the respective bond conditions and subscription documents.

How does tokenization work and which blockchain is used?

Tokenization allows legitimate ownership claims to be recorded and, at the same time, these claims can be traded. The investment property is acquired through the capital raised and potentially through bank financing. A digital share of one euro each is shown on the blockchain. After successful financing, tokens worth the entire investment amount are issued. Each investor receives a number of tokens according to their investment. This concept is implemented using smart contracts, which digitally define the conditions of the capital investment. After the tokens have been issued to investors, a logged order book is created, which enables the legal identification of current investors. The underlying blockchain is a private permissioned blockchain on Ethereum that meets the strict regulatory requirements in Germany. This ensures legal security for investors. Using a private permissioned blockchain avoids using a decentralized blockchain with hundreds or even tens of thousands of servers, which significantly reduces the environmental footprint. The few servers used are also located in CO2-neutral or compensated data centers.

Which tokens are used and how are they stored?

Security tokens are used that have the same or similar rights as “classic” securities. Securities-like rights are membership rights or debt claims with asset content, similar to shares and debt securities. They then generally represent securities (“Securities sui generis”) within the meaning of Regulation (EU) 2017/1129 (ProspektVO), the Securities Prospectus Act (WpPG) and the Securities Trading Act (WpHG) or financial instruments within the meaning of the Banking Act (KWG) and the Securities Institutions Act (WPIG). For the secure storage of security tokens, a wallet is available to every user as a digital locker for personal storage. No deposit is required and there are no costs for personal safekeeping. The wallet is connected to a login to the technical platform. Neither FINEXITY nor the trading partners have access to users' login data, and the private key to the wallet is also secured in encrypted form by an external authorization and authentication provider. A double opt-in procedure is used for users' email addresses, and every transaction approval is made via mobileTAN via mobile phone number (2FA procedure).

FAQ — Frequently asked questions

Here you can find answers to the most frequently asked questions about FINEXITY.

Statutory risk notice:

The purchase of these securities involves significant risks and may result in the complete loss of the capital invested.

Note in accordance with § 3 (2) WpIG:

Finexity Invest GmbH is a contractually tied agent within the meaning of Section 3 (2) WpIG and, when brokering financial instruments in accordance with Section 2 (2) No. 3 WpIG, acts exclusively for the account and liability of Effecta GmbH, Florstadt. Finexity Invest GmbH is reported to BaFin as a bonded agent.

Bafin Register Baid Agent (Register number: 80178615).