Inflation, recession, depression? How investors should react to the challenging economic situation

The inflation rate in Europe is currently relatively stable at around ten percent. A record figure that was last achieved in the post-war period. It's no wonder that companies, consumers and investors are currently unsettled. On the one hand, rising prices for food, energy and many other services and products are weighing on the household budget and savings account. On the other hand, even rising interest rates are not enough to even approximately compensate for the record inflation rate. The resulting loss of assets is a challenge for many investors. Find out what inflation, recession and deflation mean, and how investors should now protect themselves against potential financial market risks.

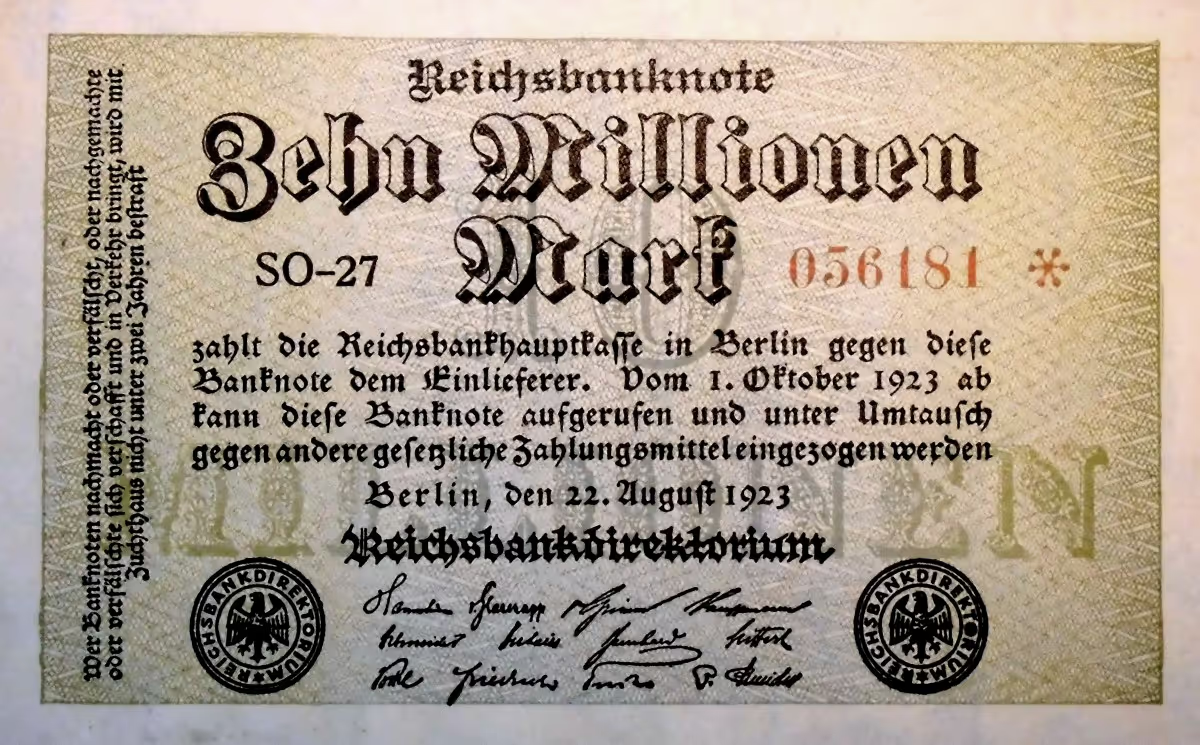

Inflation: When money becomes worth less

In short, inflation means depreciation of money. It describes the rise in price levels in a country over a specific period of time. If the general price level rises, you can buy fewer goods and services for each unit of money.

But what actually leads to inflation? One main reason is the expansionary monetary policy, in which the central bank pursues a course that increases the money supply. Although this results in more money in circulation, it does not lead to immediate increases in production. This means that an increasing supply of money meets a constant supply of goods. As a result, prices rise and purchasing power falls. The long-standing, expansive monetary policy of central banks is now clashing with the corona pandemic, the war in Ukraine and the associated negative consequences for companies and consumers - which has further fuelled inflation.

A term often used in connection with inflation is the inflation rate. This is done in Germany with the help of the so-called Consumer price index measured. It simulates a fictitious household “shopping cart” consisting of housing costs, energy costs, travel expenses and consumer goods and shows how high the percentage of these expenses is in the respective household budget.

In total, the shopping cart contains 650 different types of goods, which, however, are weighted differently. This is because households usually spend more money on rent than on clothing, for example. Accordingly, spending on rent is more important when calculating the inflation rate. Of course, this shopping cart must be constantly updated and trends adjusted. For this reason, the weighting is updated every five years, while the products in the shopping cart are constantly adjusted in order to be able to keep up with the realities of life.

It is also interesting to take a look at individual components of the shopping cart or their price change: In September 2022, for example, firewood was 105% more expensive, sunflower oil cost 80% and milk 35% more. Based on all weighted goods and services, the Federal Statistical Office then calculates the consumer index, which shows an average of the price changes of the included goods compared to the previous year.

Deflation: Abandoning consumption with consequences

A price increase is called inflation; a price reduction is called deflation. What sounds good to consumers is, however, a dangerous situation for the economy that can trigger a downward vortex. Because although prices start to slide and keep falling, deflation is more likely to result in a reduction in consumption: Consumers postpone spending and purchases because they hope that prices will fall even further.

As a result, companies lower their profit expectations, the willingness to invest decreases and production is shut down. As a result, operational restrictions such as short-time work or the closure of entire sites are likely. Unemployment is rising and leading to loss of income, which in turn reduces demand for consumer goods and causes government tax revenue to fall.

Because, for example, the ECB (European Central Bank) has often had difficulties in keeping the inflation rate above the two percent target in recent years, the “spectre of deflation” has repeatedly appeared in the room. But this constellation has completely changed since the end of last year. It is no longer deflation but inflation that is the dominant issue and could even result in a recession in many countries.

Recession: The economy is shrinking

A recession occurs when the economy does not grow but shrinks or is associated with a significant decline in gross domestic product (GDP). In Europe, we speak of a recession when that GDP for the current year is below the previous year's figure for two quarters in a row. Recession is one of the four phases that an economy's business cycle can go through. It usually follows the boom phase and, in the worst case, can turn into a depression. There are many causes of a recession. According to a report by economic experts, high inflation is currently very likely to become a German GDP fell by 0.2 percent in 2023 lead. Economic growth of 1.7 percent is still being achieved this year.

Inflation, which in Germany could still exceed seven percent in 2023, is reducing the purchasing power and willingness of consumers, who would rather save their money than spend it on goods and goods. As a result, demand is lower, industry produces less and unemployment rises. In addition, there are currently delivery difficulties and high energy prices, which can further aggravate the situation for the economy and promote the recession predicted by economic experts.

How can investors protect their portfolio now?

It could be some time before the two percent inflation target set by the ECB is reached again and we are in an economic upswing. Investors should therefore react to inflation and the impending recession now and adjust their investment strategy. But what options are there to achieve returns in the short and medium term despite the challenging market phase?

In view of rising interest rates, saving appears to be an option again. However, since even fixed-term deposits with a ten-year term yield only around three percent interest (as of November 2022), the return is far from sufficient to compensate for the inflation rate of over ten percent.

The stock markets could also have a surprise or two in store. Some analysts assume that the impending recession on the markets has already been “priced in”. Nevertheless, there is a risk that indebted companies in particular will face financial difficulties due to rising interest rates, high energy costs and low demand.

One asset class that persists in almost every crisis is real estate, but also collectibles or diamonds. For example, real estate prices could fall temporarily, but the regular “return” - i.e. rental income from properties - persists.

There is also a current trend when it comes to collectibles, fine wine and diamonds: Many investors are rearranging their portfolio and fleeing to asset classes that develop relatively independently of financial market developments. Art, fine wine and classic cars in particular have already shown a very low correlation with the markets in the past. For example, the important for the art industry is Mei Moses All Art Index Despite all crises, it has risen steadily since the 1950s. The increase in Fine Wine Index Liv-ex 1000, which has grown by almost 20 percent over the past twelve months.

Thanks to specialized platforms, tangible asset investments in real estate, collectibles or diamonds are now even accessible to retail investors. Investors can purchase digital shares from as little as 500 euros and thus acquire a diversified and flexibly tradable portfolio of tangible assets put together, which offers return opportunities even in difficult economic times.